In the fast-paced and ever-evolving domain of finance, individuals discover themselves exploring a complex territory where the craving for an improved way of life regularly collides with the imperatives of a meticulously made budget.

The interest in a comfortable and satisfying life prompts people to investigate innovative monetary roads. In this scene, the “pay afterward” alternative in loans through an instant loan app has developed as an especially enticing pathway.

Maximizing the Pay Afterward Alternative in Advances With These Steps

1. Understanding the Pay Afterward Landscape

Before making lifestyle adjustments, it’s vital to grasp the essentials of the pay later choice. This strategy, frequently related to advances and credit facilities, empowers people to make purchases without a quick budgetary cost. Instead, the installment is deferred to a later date, advertising a breathing space that can be tackled wisely.

2. Develop Monetary Awareness

The first step towards leveraging the pay later choice with a money loan is developing an increased sense of budgetary mindfulness. Routinely screen your wage, costs, and investment funds.

Understanding your budgetary inflows and outflows enables you to create educated choices when selecting the pay-later facility. Utilize budgeting apparatuses and apps to pick up bits of knowledge into your investing patterns and distinguish areas where this alternative can be ideally applied.

3. Adjust Buys with Necessities

Strategically aligning your purchases with necessities could be a key viewpoint of coordinating the pay-later choice into your way of life. Save its use for fundamental things or services that enhance your quality of life.

Focusing on needs instead of wants can guarantee that the deferred payments in your personal loan plan contribute to your general well-being.

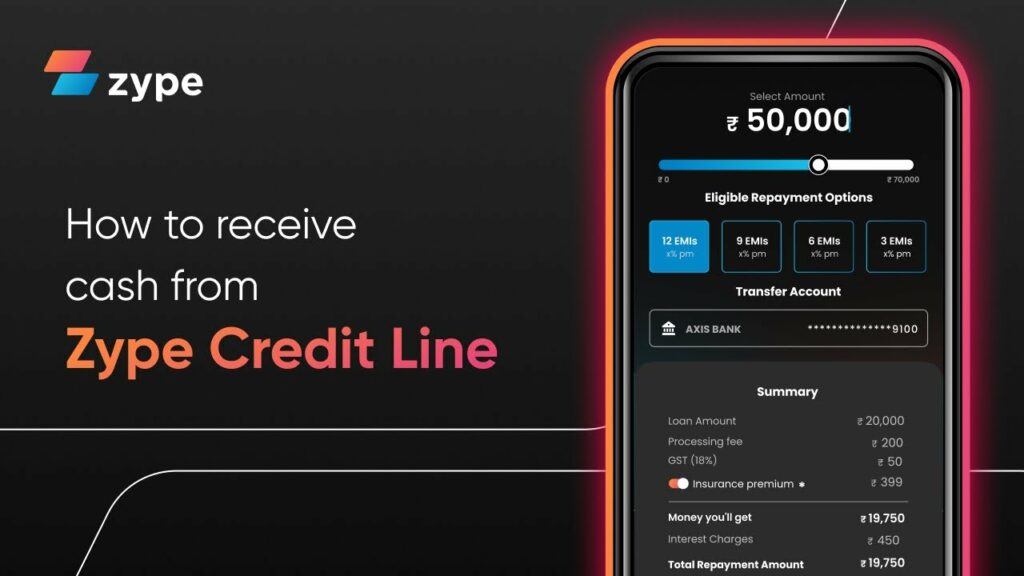

4. Select the Correct Payment Plan

Not all pay-later choices are made equal. It’s important to carefully scrutinize and select the installment plan through a personal loan app that aligns with your money-related capacity. Pick plans that offer reasonable interest rates and adaptable reimbursement terms.

Conduct careful research on the terms and conditions of different providers to create an educated choice that complements your money-related goals.

5. Make a Committed Pay Later Fund

To dodge the pitfalls of overspending and collecting obligations, consider making devoted finance particularly reserved for paying later reimbursements.

Distributing a parcel of your investment funds towards this support guarantees that you simply have a dependable source to settle deferred payments instantly, preventing any monetary strain.

6. Grasp Keen Shopping Habits

Harnessing the pay-later alternative isn’t just about what you purchase but also how you purchase. Grasp smart shopping habits, such as comparing prices, waiting for deals, and using discounts.

By being a discerning shopper, you’ll be able to maximize the value of your buys and, in turn, optimize the benefits of the pay-later facility.

7. Routinely Review and Adjust

Financial scenes advance, and so should your approach to utilizing the pay later option. Frequently survey your budgetary standing, assess your spending habits, and alter your utilization of the pay later office in like manner.

This energetic approach ensures that you can take advantage of its adaptability without falling into money-related pitfalls.

Conclusion:

Incorporating the pay-later option into your way of life could be a vital move toward financial adaptability.

By understanding the scene, developing budgetary mindfulness, adjusting purchases with necessities, choosing the right installment arrangement, making committed support, grasping savvy shopping habits, and routinely investigating and altering, you can tackle the total potential of this innovative budgetary device.

Remember that the key to creating a satisfying and economical way of life is to balance comfort with monetary judiciousness.